Chinese Crypto Mining Moves Underground

Guess Who's Back… Back Again…

China is back in the bitcoin-mining game, despite a major crackdown on the crypto industry there in 2021. According to recent data from the Cambridge Centre for Alternative Finance (CCAF), China’s contribution to the global hashrate spiked from 0% in July/August 2021 to 22.29% in September 2021. It settled around 20% in October and remained there through January 2022 (where the data concludes).

The People’s Bank of China declared (multiple times) in 2021 that crypto transactions were illegal in the communist country — individuals within China’s borders involved in any part of a crypto transaction (including but not limited to trade facilitators, developers, and even market strategists) would be subject to criminal investigation for attempting to “disrupt the financial market”. They also shut down mining in the Sichuan province, causing a huge migration of mining offshore. Now it seems that many of these Chinese miners have started continuing their operations underground. In an official statement, the CCAF said:

“Access to off-grid electricity and geographically scattered small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban."

It is assumed that miners most likely have found success hiding their locations via the use of proxy servers.

Producing 20% of the global Bitcoin network hashrate places China as the second largest mining country in the world, behind the United States. Many describe bitcoin mining as “solving puzzles”, so perhaps finding safe locations to mine is just one part of the puzzle at hand.

Bukele’s Bananas Bitcoin Banker Bonanza

El Salvadorian President, Nayib Bukele, held a conference this week with central bankers from around the world — to discuss financial inclusion, and within that broad spectrum, bitcoin. The conference lasted 3 days and was attended by officials from 44 developing countries. President Bukele tweeted his satisfaction with a sunny picture of the participants.

The conference was organized by the Alliance for Financial Inclusion, in partnership with the El Salvadorian Central Bank. Head of the El Salvadorian Central Bank, Douglas Rodriguez, said of the event:

“El Salvador is proud to receive representatives from 44 central banks and financial authorities to learn about the implementation of Bitcoin and policies to promote Financial Inclusion”

The Bitcoin Beach Project team also attended and were ready to educate the guests on how to use bitcoin, set up wallets, and, most importantly, how to transfer this knowledge to real-world usage in the economy. This is the standard that El Zonte has been using since 2019, which ultimately led to the country becoming the first nation to adopt the cryptocurrency as legal tender two years later.

El Salvador seems to have become a trend-setter in bitcoin adoption, with the Central African Republic recently making it legal tender, and Panama unveiling its own plan to allow several cryptocurrencies as a means of payment. Despite warnings from the IMF, the trend doesn’t seem to be slowing down.

Terra Moves Forward

In the aftermath of Terra’s recent fall from grace, Do Kwan, founder of Terraform Labs, has announced a new on-chain governance proposal. In a tweet-storm on Wednesday, he acknowledged and gave thanks to multitudes of supporters to whom he referred as “superhuman” for putting the proposal together.

This new proposal would be a hard fork of Terra, essentially creating a new Terra blockchain altogether, along with the new $LUNA token, which will be airdropped to holders of the original token, now re-branded as LUNA CLASSIC ($LUNC).

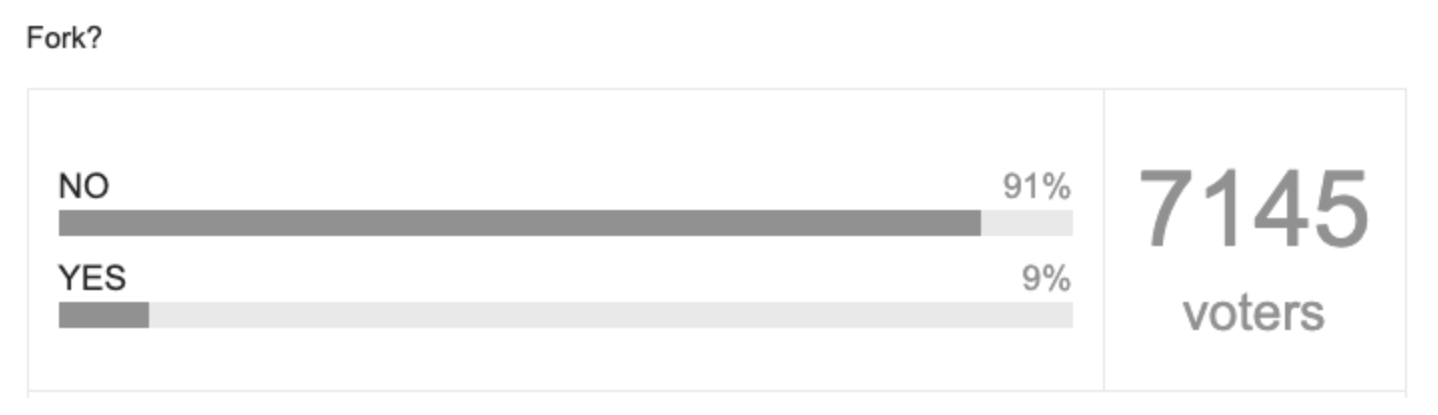

While Do Kwan is keeping his confidence high, he appears to be doing so in spite of an overall negative response from the community. A preliminary poll was created by morpheus9, saying:

“There’s no need to wait for the proposal to be published to know what the general sentiment is.”

91% have voted no.

Most who voted in the poll cited lack of trust as their primary concern. A regional director at crypto exchange AAX, Anton Gulin, said:

“The overall sentiment towards Luna across the crypto community is exceptionally harmful. Traders and investors suffered tremendous losses and doubt management’s actions that followed the UST unpegging.”

Time will tell if Do Kwan’s perseverance will be enough to put Terra back in a favorable position.

Grayscale Scales Up in Europe

Grayscale, a company that manages cryptocurrency investment funds, has officially launched its first European ETF, Grayscale Future of Finance. According to the Grayscale official statement on Globe Newswire, the new ETF:

“...tracks the investment performance of the Bloomberg Grayscale Future of Finance Index and seeks to offer investors exposure to companies at the intersection of finance, technology, and digital assets – companies that are building the digital economy – all through the familiar ETF wrapper.”

They outlined three “Future of Finance” pillars to explain which kinds of companies fall under the Index’s umbrella:

Financial Foundations – asset managers, exchanges, brokerages, and wealth managers involved in the enablement of the digital economy

Technology Solutions – organizations providing the technology to facilitate the digital economy through data and processing

Digital Asset Infrastructure – includes companies directly involved in mining, energy management, and activities that power the digital asset ecosystem

Popular companies like Block, Coinbase, PayPal, and Robinhood are amongst the plethora of companies tracked by the ETF.

They are well known for creating the largest publicly traded bitcoin fund in the world (GBTC), and now their new product will be tradable on the London Stock Exchange, Borsa Italiana, and the Deutsche Börse electronic trading platform, Xetra, under the ticker symbol GFOF.

The Regulatory Beast MUST EAT!

The Biden Administration plans to put pressure on Congress to mandate the separation of customer and corporate crypto funds. The call to action is inspired by 2 things:

The disappointing earnings report from Coinbase this week that shows the stock price has decreased by 80% from its ICO in April of last year

The report’s update to the company’s worst-case scenario bankruptcy proceedings

“...custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors. This may result in customers finding our custodial services more risky and less attractive and any failure to increase our customer base, discontinuation or reduction in use of our platform and products by existing customers as a result could adversely impact our business, operating results, and financial condition.”

Frightening words. However, Coinbase CEO Brian Armstrong tweeted out a thread apologizing for the scare and assuring customers that it is not indicative of any drastic action in Coinbase’s future; but rather just a requirement as per the SEC’s recent disclosure policy update:

Coinbase was required to include language about bankruptcy in a required earnings report, and now the government wishes to use the effects of this announcement as ammunition to push further regulation.

The proposed separation of individual customer holdings from corporate holdings in custodial wallets is aimed to insulate users from any potential fallout that would put these funds at risk. The framework for this is based on the Commodity Futures Trading Commission’s current model for stock market futures trading.

A good time to remind people: not your keys, not your coins.

By Will Sandoval, NBTV Associate Producer, and Naomi Brockwell.