Panama is 3rd Country to Make Crypto Legal Tender

A Global Crypto Crackdown Agreement

European Union Financial Services Commissioner, Mairead McGuinness, invited the United States this week to create a “global crypto agreement” with the EU.

In an op-ed she wrote for The Hill, McGuinness expressed satisfaction about the Executive Order signed by President Biden last March, and the EU Digital Finance Package (which is nearing completion) that will introduce stricter regulation for the crypto sector. She stated her intentions for a “global approach” where "no product remains unregulated":

“I believe that the EU and the U.S. can together lead the way on a shared international approach to regulating crypto. Together, we can enable innovation in finance, while protecting consumers and maintaining financial stability.”

While paying lip service to the usefulness of crypto, McGuinness built a case for regulation by focusing on “protecting investors”, “deterring money-laundering”, “high volatility,” and the “environmental impact” of crypto. She also mentioned that the European Central Bank has been exploring the implementation of a digital euro and that she and her team “stand ready to propose the necessary legislation”.

One interesting part of her op-ed was about the continuing war in Ukraine, and how a big question remains as to how to enforce current crypto sanctions. With no central focal point in crypto, it is indeed difficult to enforce any kind of prohibition. In such battles against the decentralized world, intimidation and a show-of-strength will become increasingly important for government to rely on, as these will encourage people to self-regulate. An EU/US regulatory partnership could definitely assist with such a flex.

The US has not yet publicly responded to McGuinness’ call to action.

Panama Makes Crypto Legal Tender

Panama’s National Assembly has passed new legislation that will make bitcoin and eight other cryptocurrencies legal tender in the Central American country.

All that is left is for Panamanian president, Laurentino Cortizo, to sign it into law.

Panamanian lawmaker, Gabriel Silva, who promoted the bill on Twitter, said:

“This will help Panama become a hub of innovation and technology in Latin America.”

The draft bill states that the following cryptocurrencies, “without limitation”, can now be used as official payments: bitcoin, algorand, elrond, ethereum, IOTA, litecoin, stellar, XDC network, and XRP. Simultaneously, the bill announces an official digital wallet that will be launched alongside the legislation to help citizens “carry out transactions of these new technologies in a safe way". The bill also adds language permitting the future “tokenization of precious metals and other goods”.

The elevation of bitcoin and other cryptocurrencies to the status of legal tender does not replace Panama’s fiat currency, the balboa.

Some people have expressed concern over this small country’s move towards crypto adoption. Panama was famously exposed in 2016 as being a tax haven for public figures and the wealthy elite — in an interview with Fortune, tax barrister Patrick Cannon gave crypto the usual smear by saying the law would now attract:

“... all sorts of fraudsters and people who deal in things they shouldn’t be dealing in”.

Once the bill is signed, Panama will become the third country in the world to adopt bitcoin as legal tender, and the first to adopt the other eight. Though there are many hurdles to clear and minds to change, it is a landmark moment for crypto and Panama. Felicidades!

SEC’s Crypto Enforcement

In a press release released on Tuesday, SEC chair, Gary Gensler, announced the renaming and expansion of its crypto enforcement department. Formerly known as the “Cyber Unit”, the newly rebranded “Crypto Assets and Cyber Unit”, which has now doubled in size with the addition of 20 new positions, will focus on the following issues:

Crypto asset offerings

Crypto asset exchanges

Crypto asset lending and staking products

Decentralized finance ("DeFi") platforms

Non-fungible tokens ("NFTs")

Stablecoins

Gensler expressed pride in the policing accomplishments of the team so far and hopes to “ensure investors are protected in the crypto markets” through this new expansion:

"The Division of Enforcement’s Crypto Assets and Cyber Unit has successfully brought dozens of cases against those seeking to take advantage of investors in crypto markets. By nearly doubling the size of this key unit, the SEC will be better equipped to police wrongdoing in the crypto markets while continuing to identify disclosure and controls issues with respect to cybersecurity."

Naturally, the crypto community had something to say about this.

Even Crypto-Mom herself, SEC Commissioner Hester Peirce, called out Gensler’s press release:

The SEC continues to crusade against unregistered securities (which includes apparently… everything) rather than focusing on actual fraud. They have instigated lawsuits against important platforms in the blockchain ecosystem where no consumer has even filed a complaint. And now they’re patting themselves on the back for wasting countless man-hours and mountains of capital — resources that could have gone towards building better a better, more decentralized future. We’re all for protecting people from fraud, but the SEC has set back innovation considerably, and we can’t help but think we’d be better off if the organization were abolished.

PayPal Chokes Off Funding for Independent Media

PayPal, over the past couple of weeks, has suspended a slew of independent media sites without explanation, including Consortium News and MintPress. Journalist Matt Taibbi released an article on his Substack diving into how these sites have all been consistently anti-war and critical of U.S. intelligence agencies. He also talked of financial censorship’s power to control speech:

“Going after cash is a big jump from simply deleting speech, with a much bigger chilling effect. This is especially true in the alternative media world, where money has long been notoriously tight, and the loss of a few thousand dollars here or there can have a major effect on a site, podcast, or paper.”

Obviously this isn’t the first time that financial intermediaries have wielded their immense power to try to silence certain ideas or groups. In 2010, along with all the major credit card companies, PayPal famously blocked donations to Wikileaks — at the behest of the US government. In 2018, Patreon went on a rampage deplatforming creators. Banks themselves have notoriously shut down the accounts of anyone who worked in an industry that the FDIC deemed “high risk”, from crypto users to marijuana research firms. More recently, the accounts of Canadian protestors were frozen and donations seized without due process.

Taibbi observes that “deleting posts or censoring content is one thing, threatening an organization’s existence is another.” Indeed, if you can shut down the funding to a business or platform, you can choke it out of existence.

Daniel Kuhn remarked how writers like Taibbi have been “notably skeptical or silent about crypto”, yet how decentralized digital money is the obvious solution to such examples of financial censorship. Hopefully with time, more and more people will understand the full potential of crypto as a tool for freedom.

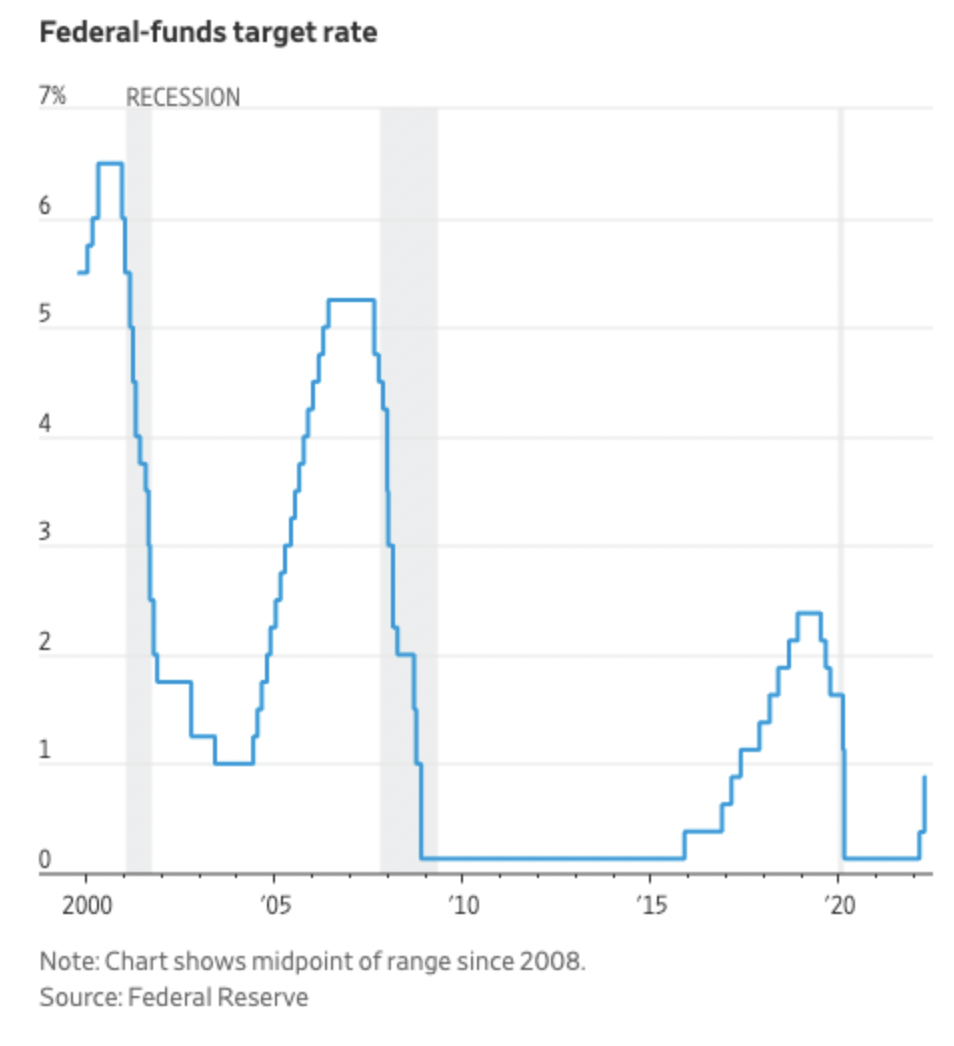

Biggest Interest Rate Hike in 22 Years

For the first time in 22 years, the Federal Reserve has approved a rare .5% interest rate hike. In a plan to shrink its balance sheet and reduce inflation currently at a 40-year high, the Fed is ramping up efforts to tighten monetary policy. The central bank’s benchmark federal-funds rate will target a range between 0.75% and 1%. U.S. stocks plunged this week in reaction to the tightening.

Despite all the financial media focusing on the fact that this is the biggest interest rate hike since 2000, it’s important to remember that interest rates are still at historic lows.

What do we expect will happen to the stock market as we get interest rates back to normal levels? The Fed has indeed kicked the can down the road for too long — as economist George Selgin remarked, team “transitory” continued to deny any need for tightening as late as 2021:Q4. The result is raging inflation — USD-users have permanently lost at least 8.5% of their purchasing power in the past year. Inflation is perhaps worse now than it was in the 1970s, when measured by the same CPI used to measure inflation at the time.

Putting a central bank in charge of the money supply means giving them the power to print obscene amounts of money. They eventually use that power, and this is why bitcoin has been alluring to so many — it takes the ability to debase money out of the hands of bureaucrats, and establishes a predetermined inflation schedule not at the whim of any individuals.

There’s tremendous power in decentralized money supplies. Crypto may prove to be one of the most valuable antidotes to reckless monetary policy we’ve ever had.

By Will Sandoval, NBTV Associate Producer, and Naomi Brockwell.