Zcash Upgrade: Goodbye Trusted Setup! Hello Privacy Revolution!

Zcash is the Master Chief of Privacy

Zcash (ZEC) activated its much anticipated Network Upgrade 5 on Tuesday, marking the elimination of the famed trusted setup, and a milestone in privacy technology.

What was the Trusted Setup?

Zcash’s first 2 privacy pools required that a secret key be generated in order to initially set up their privacy parameters. The problem is that anyone who knew that secret key would be able to forge coins. The privacy of Zcash wouldn’t be undermined, but it would be difficult to prove the soundness of the Zcash money supply. Zcash developers tried to mitigate this by designing a multi-party computation, known as “The Ceremony”, where the secret would be divided amongst 6 people — If any 1 of those 6 participants succeeded in throwing away their part of the key, the computation would be secure. The extreme measures of the participants (which included Edward Snowden) to protect their part of the computation have gone down in crypto folklore.

This new upgrade, however, relegates this mysterious event to a distant past, because Zcash researchers figured out how to eliminate the trusted setup entirely. This means that the soundness of the Zcash monetary base is no longer reliant on the Ceremony participants.

“Halo is not only a scientific breakthrough (https://eprint.iacr.org/2019/1021) but also now a general-purpose, industrial-strength building block crafted by the legendary Electric Coin Co team, with years of diligent labor,”

said Zooko Wilcox, CEO of Electric Coin Company.

This is the first Zero-Knowledge Proof system that is both:

(a) efficient and recursive

(b) doesn't rely on Ceremonies ("trusted setups")

Zooko added that “because of this unique combination of properties, Zcash Halo will likely form the basis of many never-before-possible forms of decentralized computation, both in future upgrades of Zcash, and beyond.”

The new upgrade also supports “shielded by default”, which aims to ensure the best on-chain privacy, as simply as possible. It means that when you move funds to a wallet that uses “shielded by default”, even if you are withdrawing from a centralized exchange, the money you withdraw will be automatically shielded — no one can see when that money moves again, even if the funds were KYCd in the first place.

Huzzah, Zcash! Here’s to moving the privacy revolution forward!

US Charges Former NFT Executive with Insider Trading

The US Department of Justice has officially charged former head of product at OpenSea, Nate Chastain, with wire fraud and money laundering in connection with a scheme to commit insider trading in Non-Fungible Tokens. This is the first insider trading case involving NFTs, and one that will set many legal precedents going forward. In an official statement, U.S. Attorney Damian Williams expressed that the platform on which the crime was committed makes little difference in the criminality of Mr. Chastain’s alleged actions:

“NFTs might be new, but this type of criminal scheme is not. As alleged, Nathaniel Chastain betrayed OpenSea by using its confidential business information to make money for himself. Today’s charges demonstrate the commitment of this Office to stamping out insider trading – whether it occurs on the stock market or the blockchain.”

Nate Chastain, 31, was indicted on Wednesday this week for using his confidential knowledge of which NFTs were going to be featured on the OpenSea marketplace for his own personal gain. According to the indictment, Chastain used anonymous crypto wallets to “secretly purchase dozens of NFTs shortly before they were featured” and proceeded to sell them for up to five times the profit.

OpenSea fired Chastain in September over the allegations. It makes sense why the company considered this unethical behavior. However, it’s less clear why this sort of thing should involve the government, and indeed some argue that insider trading should be legal:

“[All] an inside trader does is act on private information that more accurately reflects the future value of some financial asset than the current price does. He buys or sells that asset at a price that someone else voluntarily accepts. He does nothing that damages (or falsely props up) the ultimate value of the asset. Nor does he hurt the broader financial marketplace; if anything, his trading slightly pushes the asset price toward a more appropriate value.”

Something worth thinking about.

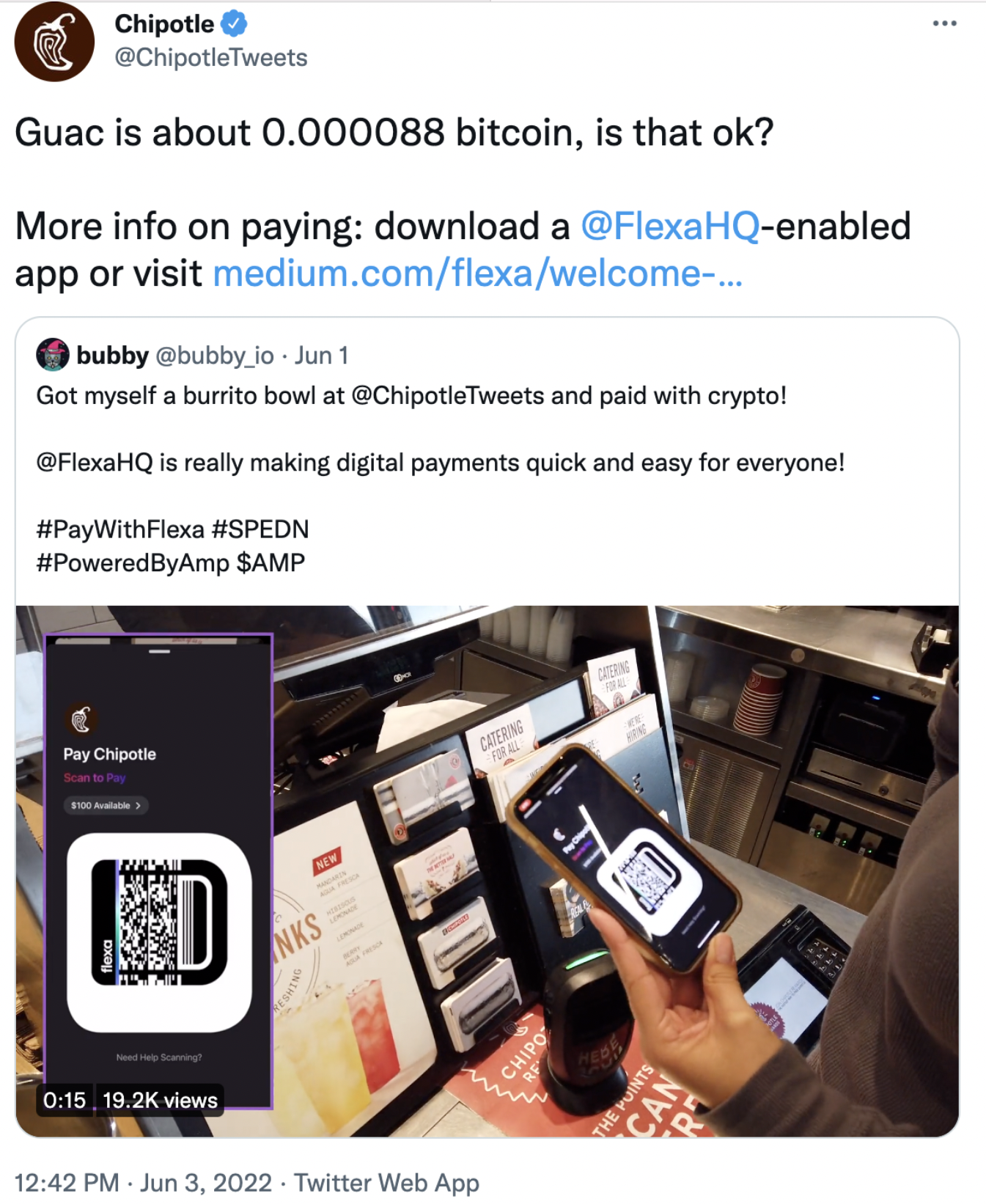

Chipotle Adds Crypto to the Menu

Chipotle, everyone’s favorite lunch-place excursion, has partnered with crypto-payment app Flexa to allow hungry customers in the US and El Salvador to pay using their favorite cryptocurrencies.

Flexa is a digital payment app that acts as a payment interface. The aim is to allow customers to use any currency of their choice, and for merchants to then receive any currency of their choice. Users can connect their crypto wallets, and use any of the currently supported 99 cryptocurrencies, including Bitcoin, Ethereum, Zcash, Cardano, and a slew of others. Even Elon Musk could buy lunch for his team using Dogecoin, if he wished.

One of Flexa’s goals from their inception has been to make paying in crypto a seamless process. Historically, crypto transaction times have been known for being a terrible slog: Flexa aims to improve that. According to their official blog:

“Flexa Payments aims to provide the simplest, most friendly interface for accepting payments from the wide variety of digital currency wallet apps and networks available today. To accomplish this objective, we’ve built a comprehensive library of diligently researched information about how each and every app best supports the different payment protocols for digital asset payments—including QR code payment requests, deep links, URL schemes, and more. Every time a customer chooses to make a payment with digital currencies, Flexa Payments takes into account that customer’s desired app or network, their payment context (e.g., in person, online, or inside of your mobile checkout app), and its own deep database of app information, and then intelligently surfaces the ideal payment request format on a network-by-network basis for a seamless transaction”.

Flexa is currently compatible with the Gemini and SPEDN apps, and support for other popular apps such as DashDirect, Nighthawk, and Valora are coming soon.

To make matters even tastier, Flexa is offering Chipotle customers a 10% discount on their next meal! Go get that Guac!

It’s great to see more ways for people to use their crypto everyday. If you want to learn about how to incorporate crypto into your everyday life, check out our video, where we interview Flexa CEO Tyler Spalding, and also take a look at out video about the best crypto credit cards that don’t require KYC.

A Certain Point of View …

A cohort of 26 pro-regulation technologists composed and sent a letter to 12 US Congressional leaders this week, urging them to “resist pressure from digital asset industry financiers, lobbyists, and boosters to create a regulatory safe haven for these risky, flawed, and unproven digital financial instruments”.

They all expressed their disagreement that crypto is the future of finance, and claimed that only those with a hearty financial stake are the only ones who stand to benefit.

“We strongly disagree with the narrative — peddled by those with a financial stake in the crypto-asset industry — that these technologies represent a positive financial innovation and are in any way suited to solving the financial problems facing ordinary Americans.”

Many in the crypto industry pushed back against the letter, including Vitalik Buterin. He noted his surprise and disappointment that popular tech writer, Cory Doctorow, had signed the letter. Doctorow is widely known for his “Decentralize, Democratize, or Die” keynote speech at the DevCon annual Ethereum developer conference in 2018.

Buterin continued in a tweet-storm response to the letter:

Buterin noted that the anti-crypto sentiments and infighting plaguing the blockchain landscape are an inevitable part of the changing and growing community:

“This is an inevitable part of becoming bigger. In non-financial movements too, various classes of normies and often soon grifters move in over time.”

Binance Joins the Party

Binance Labs (Binance’s venture capital branch) has sealed deals with multiple global institutional investors to create a $500M fund which will be focused on blockchain and Web 3 companies. According to their official blog, DST Global Partners, Breyer Capital, and Whampoa Group are named as official supporters, and “other major private equity funds, family offices, and corporations also subscribed to the fund as limited partners”.

The overarching goal of the project is said to “extend the use cases of cryptocurrencies and drive the adoption of Web3 and blockchain technologies”. Binance Labs plans to do this by providing investment fuel for three financial growth stages: incubation, early-stage venture, and late-stage growth.

Founder and CEO of Binance, Changpeng Zhao ‘CZ’, said:

“In a Web3 environment, the connection between values, people, and economies is essential, and if these three elements come together to build an ecosystem, that will accelerate the mass adoption of the blockchain technology and crypto. The goal of the newly closed investment fund is to discover and support projects and founders with the potential to build and to lead Web3 across DeFi, NFTs, gaming, Metaverse, social, and more”.

Binance Lab’s entrance into the Venture Capital realm is further proving that, while the retail sector is still being mauled by the bear, the future of crypto remains longterm bullish.

By Will Sandoval, NBTV Associate Producer, and Naomi Brockwell.