Bitcoiners Mix Among the Tanned, Beautiful, and Art Deco in Miami

Bitcoin 2021 is the first major conference of its kind since the pandemic, and is expected to draw tens of thousands

Miami, Florida in the United States occupies rarified air nestled between the Everglades and Biscayne Bay. It’s where Cuban expatriate culture breathes a virulent form of free marketism to a distinctly Caribbean beat.

Cosmopolitan, skyscraper-dominated skylines, postcard beaches, pastel colors, and men who wear shirts two sizes too small are all fundamental hallmarks.

Miami ranks just behind Los Angeles and New York as one of the wealthiest cities in the US.

Miami is a hustle. It gets down. It’s can-do. In other words, it is the perfect staging for a financial revolution.

It is no wonder, then, that its local politics can sometimes reflect those above realities. Mayor Francis X. Suarez has characterized his reign as among the most pro-cryptocurrency pols in the US outside of relative safe spaces like Wyoming.

Fittingly, Mayor Suarez kicks off the Bitcoin 2021 Conference, welcoming attendees June 4-5... who will number in the tens of thousands. Press coverage alone, thanks to the likes of Suarez openly embracing money’s future, will continue to no doubt boost in-real-life Bitcoin gatherings many fold.

This is a first such soiree since The Before Times. Lots of steam to blow off, and organizers at Bitcoin Magazine pulled all the stops this year.

Speakers include two-time US presidential candidate Ron Paul, disruptive sporting entrepreneur and skating legend Tony Hawk, Twitter and Square CEO Jack Dorsey, and scores more celebrities and influencers, developers and exchange operators, miners and philosophers will populate breakout rooms and panels in Miami.

Bitcoin in particular and crypto in general is in a really interesting psychic space at the moment. It’s mooning, albeit among fits and starts, and more people are aware of the phenomenon than at any time in the ecosystem’s history.

And yet even crypto veterans cannot tell you where this is all headed.

Something’s happening, that’s for sure. For those unable to attend, the conference is being livestreamed here.

Regulators Signal What’s to Come

Gary Silverman and James Politi recently explained:

“US financial authorities are preparing to take a more active role in regulating the $1.5tn cryptocurrency market as concern grows that a lack of proper oversight risks harming savers and investors.”

And while that’s hardly revelatory or shocking, Michael Hsu, acting comptroller of the currency, told Silverman and Politi, “It really comes down to co-ordinating across the agencies.” They point to a meeting of “an inter-agency crypto ‘sprint’ team, involving officials of the three leading federal bank regulators — Hsu’s Office of the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corporation,” as further proof regulators are keen to not allow the crypto ecosystem to get too much bigger before becoming unwieldy.

Central Bank Digital Currencies are a Must

Christine Lagarde, President of the European Central Bank (ECB), published her Foreword to The international role of the euro, June 2021. ECB economists Massimo Ferrari and Arnaud Mehl authored the report proper to which Lagarde prefaces, stating “attention should be paid to the risks to stability that might arise if a central bank does not offer a digital currency," with both men stressing how "issuing a CBDC would help to maintain the autonomy of domestic payment systems and the international use of a currency in a digital world."

The Wall Street Journal Discovers DeFi

Legacy financial news is hipping-to decentralized finance (DeFi), even if reluctantly. “There are two key differences from mainstream banks,” The Journal notes, “All services are for digital currencies instead of government-issued ones such as the dollar and the euro, and there is no intermediary or centralized system through which transactions are processed.” Such a prospect strikes terror into the hearts of hotshot traditional finance, and the article is dutifully peppered with warnings about volatility and leverage. Ultimately it concludes disapprovingly, “DeFi is still an immature and highly risky market. In some cases, those running the apps are anonymous, making it harder for users to determine which platforms are reliable. The services aren’t regulated or insured, so if a platform fails there is no recourse.”

India’s Biggest Bank Assumes a Crypto Future

India weekly reveals news, nuggets about how it will once-and-for-all come down on the issue of cryptocurrencies. One report explodes with hope, while many others cite court rulings and various commissions outlawing its practical use. We’ve given up trying to predict what will happen. Too many moving parts. Recently, however, portions of a private report from HDFC reveal how the massive bank believes “it is just a matter of time before Indian investors have legal access to Crypto plays.” Again, it’s hard to know how meaningful the report is, but we’re holding onto any light that will eventually allow financial self determination for more than a billion souls.

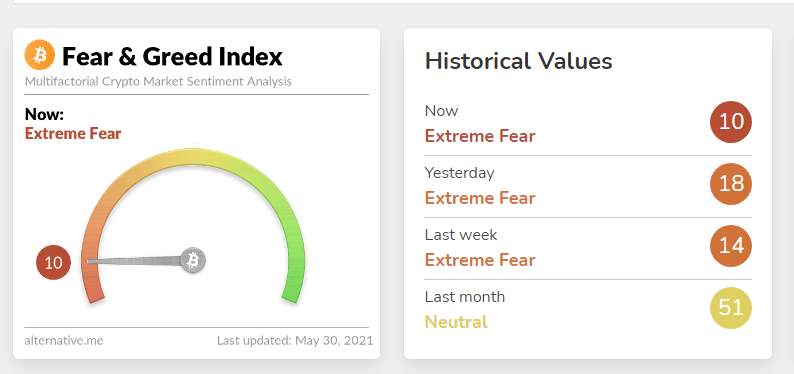

Fear & Greed

Panic set-in this week, as the Fear & Greed Index, where “Each day,” Alternative.me analyzes “emotions and sentiments from different sources and crunch them into one simple number: The Fear & Greed Index for Bitcoin and other large cryptocurrencies.” The needle reached a scary ten before slightly rebounding a few days later. As analysts explained, “Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.”

By C. Edward Kelso, NBTV Head Writer.