Helping the People of Iran

Privacy Corner

Helping the People of Iran

The internet is often controlled and censored in times of civil unrest. Governments can block certain services, like access to websites or apps, or they can even shut off the internet entirely.

That’s exactly what’s going on in Iran at the moment. Last week an Iranian woman died after being arrested by the notorious morality police there for incorrectly wearing her hijab. Protests have since broken out, with masses demonstrating, chanting, cutting off their hair, and burning headscarves in the street.

The government has partially shut down the internet as a result of the protest, and they have also blocked access to the secure and private messaging app, Signal.

There are ways we can help: Set up a proxy Signal server that Iranians can connect to, allowing them to communicate privately and securely during a hostile situation.

NBTV made a tutorial on how to do this: It’s actually super simple, but it may just involve tools that many people aren’t familiar with. Have a look at our tutorial, and see if this is something you can help with.

The video is intended to supplement the Signal tutorial found here.

You can also watch the tutorial on Odysee.

Crypto Corner

That’s What Friends Are For

US crypto advocacy group Chamber of Digital Commerce was granted approval this week from the Southern District Court of New York to participate in the legal proceedings in the case of the SEC v Ripple as an amicus curiae. The title, which is latin for “friend of the court”, gives them the opportunity to provide important expertise and insight on the matter.

The SEC is suing Ripple, claiming that the sale of their in-house token, XRP, constitutes the unlawful sale of $1.38 Billion in unregistered securities. Representatives from Ripple claim that XRP, being a decentralized currency, does not depend on the efforts of the Ripple itself to appreciate or depreciate in value and that, because of this fact, would not pass the Howey Test. The SEC contends that XRP would not be in the position it is in without Ripple’s technological and strategic investments ensuring its success.

In a document explaining their interest in the case, the Chamber laid out a clear, cautionary warning about the dangers of an SEC victory. They state that their intended goal is to ensure that “the legal framework applied to digital assets creates a clear and consistent precedent for industry members to follow”.

Currently, no federal laws or regulations exist to specifically determine how digital currencies are classified in the eyes of the law. The outcome of this case will set important precedents for the crypto industry.

Upon receiving the order, the Chamber now has until September 26th to submit their brief.

Ethereum Merge Complete!

The long-awaited Ethereum merge from proof-of-work (PoW) to proof of stake (PoS) was completed on September 15th 2022 at approximately 2:11PM Eastern Time.

Previously, Ethereum mining operated much like Bitcoin mining, where massive computations are done on high-powered, specialized machines all over the world. While many argue that this kind of crypto mining is already much greener than people think, the result of this move to PoS regardless is that energy consumption in Ethereum mining is expected to see a reduction of 99.95%, to .01 TWh/yr.

Instead of Ethereum miners performing huge computations with large power requirements competing for blocks, Ethereum now has stakers that can stake existingEthereum to secure the network. This means that anyone with 32 ETH, a stable internet connection, and a spare computer can now secure the network. Cryptography expert, Perry Metzger, made a great point about why this is bigger than a debate about energy consumption — dramatically lowering mining costs means a huge step towards alternative moneys that can compete with traditional finance at the global scale:

“Many people seem to regard the shift from proof of work to proof of stake as though it were purely an environmental consideration, and it is certainly very important not to destroy the planet. However, a vital change here is that it means operating costs can fall.

Proof of Stake is cheaper because no one has to pay giant sums for electricity. For a transaction system to pay for itself, fees must ultimately cover the operating costs, and for it to be competitive, those costs must be low.

Proof of Work defends a network by making it too expensive to attack the consensus, and it does that by spending money on electricity. The downside is, however, that the expense of running the network literally can never go down.

By contrast, the byzantine agreement for Proof of Stake requires no such expenditure, and the total cost of operating the system could ultimately be competitive with the conventional banking system. That’s a revolutionary change.

(Even the cost of the hardware needed to run a proof of stake system is vastly lower. There’s no need for giant expensive servers. You can run a node on a much more lightweight system.)

Ethereum still has some ways to go before it can be an alternative to the existing global monetary system. It needs much more transaction capacity, it needs transaction privacy, and it needs a better long term governance model which will survive the founders.

However, just this one step has been a major advancement, and I’m looking forward to seeing what happens next.”

The Ethereum Foundation has noted that the PoS merge, while not directly affecting network fees, is a critical first step in addressing this:

“Gas fees are a product of network demand relative to the capacity of the network. The Merge deprecated the use of proof-of-work, transitioning to proof-of-stake for consensus, but did not significantly change any parameters that directly influence network capacity or throughput.

With a rollup-centric roadmap, efforts are being focused on scaling user activity at layer 2, while enabling layer 1 Mainnet as a secure decentralized settlement layer optimized for rollup data storage to help make rollup transactions exponentially cheaper. The transition to proof-of-stake is a critical precursor to realizing this.”

While the crypto-community is largely celebrating this historic achievement, some do wonder about potential risks associated with the new PoS model:

If an attacker were to gain control of the majority of the staked ETH (either through purchase or through attacking major staking pools) they could gain control of the network.

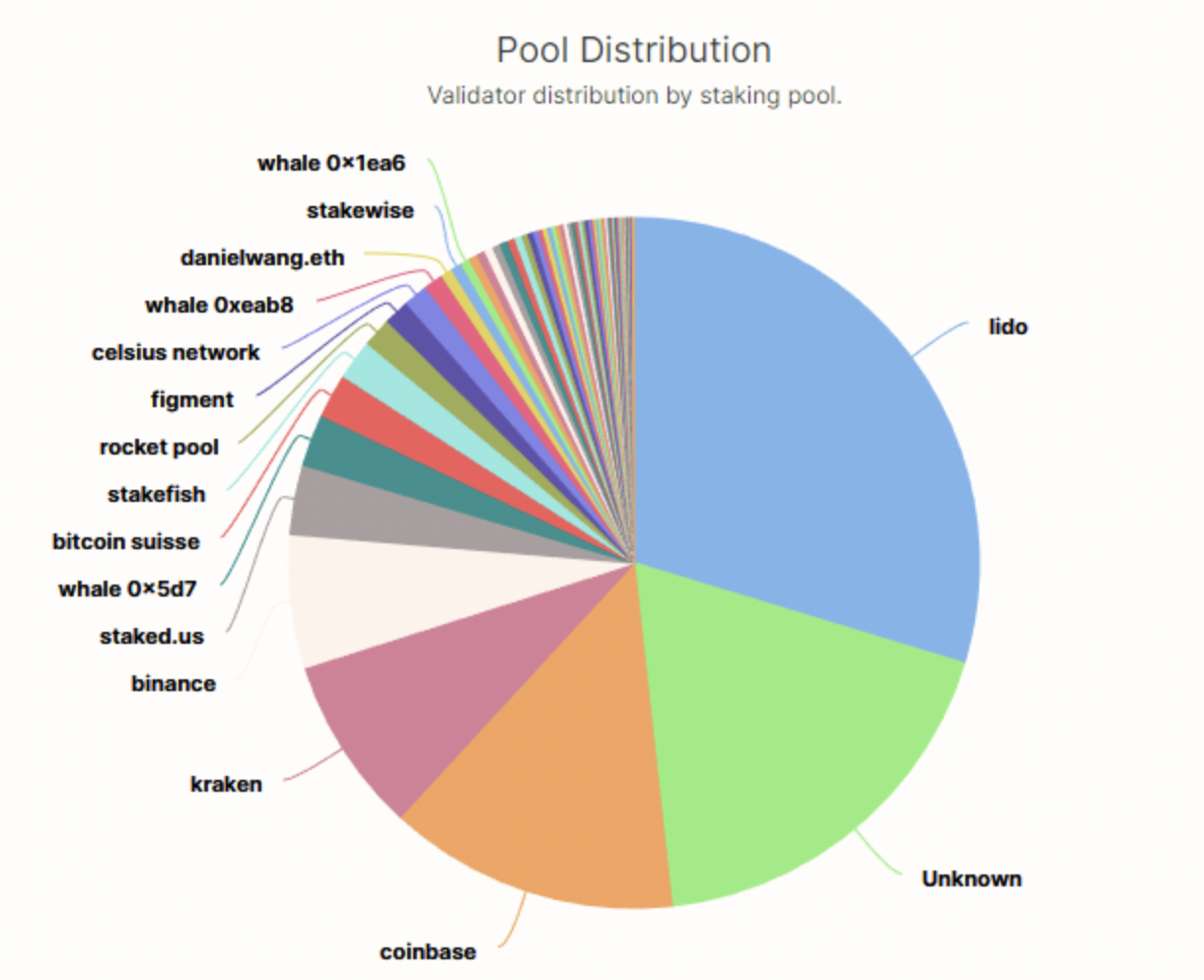

Due to about 60% of the staked ETH being under the control of just 4 exchanges, this brings huge centralization concerns (both from cooperation or coordinated hacking of these exchanges) to the Ethereum ecosystem.

There are already multiple Proof of Work forks of Ethereum that are attempting to keep the POW model intact.

Lido, Coinbase, Kraken and Binance control almost 60% of the stake on Ethereum’s new proof-of-stake network.

If you wonder what happened to “ETH 2”, the Ethereum Foundation put it concisely:

After merging 'Eth1' and 'Eth2' into a single chain, there is no longer any need to distinguish between two Ethereum networks; there is just Ethereum.

To limit confusion, the community has updated these terms:

'Eth1' is now the 'execution layer', which handles transactions and execution. [NBTV note: This is where things like NFTs and smart contracts live, as well as simple transactions.]

'Eth2' is now the 'consensus layer', which handles proof-of-stake consensus. [NBTV note: This is how new blocks are agreed upon in the new Proof of Stake model.]

For those who staked ETH for ETH 2 early on, withdrawals are still on hold until the Shanghai upgrade, which is expected in the next six to twelve months. This adds to the centralization concerns, as users cannot punish bad actors by withdrawing their funds until withdrawals are allowed.

This has been the biggest network event of this kind in the crypto world to date, and many think this will help propel Ethereum into the number one crypto spot, though, since The Merge, it has lost market share relative to Bitcoin.

By Will Sandoval, NBTV Associate Producer, and Naomi Brockwell.

Special thanks to NBTV contributors Reuben Yap and Chris Karabats.