John McAfee’s Final Troll

Crypto’s id, and the lesson of legend

“I will say this,” television journalist Kat Timpf posted upon learning of John McAfee’s (Mack-uh-fee, not Mick-caffee) death, “I once bummed a cig from John McAfee years ago at the Libertarian Convention in Orlando and we talked for 15 minutes and I’ve been bored every second of my life compared to that conversation.”

Official sourcing from Spanish authorities has McAfee, 75, taking his own life after learning of his inevitable extradition to the United States to face charges of tax evasion and fraud.

Crypto is a permissionless, low barrier to entry, wildcat universe. That’s very much its appeal. An open-to-everyone subculture welcomes all kinds. McAfee lived many lives, and probably began meaningful interaction with Bitcoin around 2013-ish if a quick Google search can be trusted. That would place him in his early 60s, fresh from a daring break out from Belize on murder charges.

Readers of these pages are no doubt aware of his prior tech background.

But, where else would a story like McAfee’s, still to make more incredible turns during the ensuing decade, find a home? Polite society was out. Bitcoin allowed McAfee to fully express himself and to form what became the crypto id.

He embraced his then-newly found nomadic philosopher role, often giving prophetic interviews around the world about the coming Bitcoin revolution. McAfee was a highly sought conference speaker, and became increasingly more libertarian over the years.

McAfee’s crypto involvement appeared to reach a peak during the 2017 initial coin offering (ICO) boom. He reveled in the variety of projects, often being brought aboard as an active participant or paid shill.

Everyone seemed to understand ICOs would largely fail. Warnings were everywhere over social media. To know about an ICO almost necessarily meant finding them on message boards or in Telegram channels or Twitter. There, fierce debates would break out about the given project’s viability and value proposition.

McAfee took-on all comers. He disclosed his involvements with flair, including stunts like the token’s logo tattooed on his back. Buying into those coins was a chance to be part of the legend, part of the McAfee wink, and maybe make a little bit of money on a lark.

When word filtered back to US regulators like the SEC, McAfee dared them to come after him. That only added to his appeal for some. More coin projects rolled out, and, ever the master of promotion, he’d eventually launch an anti-presidential campaign to stir up interest and conversation.

Again, when McAfee entered the crypto world he was a known entity. There were legions of digital ink spilled over his exploits, everything from his financial dealings to his admitted hardcore drug use to his libido.

To many of us who often take ourselves way too seriously, McAfee was a human Doge coin. He enjoyed life. Half the time you laughed with him on his adventure, but the other half had you shaking your head, smiling, wondering if he was onto something.

At another gig, when I was “Kelso, Editor-in-Chief”, I found his doings a massive distraction and hard to defend even on market anarchist grounds. I tired of charismatic libertines leading crypto. I longed for substance as a matter of course. So, I stopped covering him on purpose.

It was costly. On a readership basis, McAfee drew everyone in. He was fun to write about. Readers could not get enough of his saga. I rolled my eyes.

When he was ultimately on the run for the final time and then arrested, it was too late for me to in good conscience pick up the story again. And, in any event, he was dutifully covered throughout the crypto world and beyond.

The lone regret I have in those McAfee-related decisions was not making the case for his survival and why he was important to the future of financial freedom. It was possible, I found, to both dislike and disapprove of McAfee and his scammy projects while simultaneously pointing to his Jehovah’s Witness-like necessity for freer societies.

Yes, I might find Witnesses annoying and inconvenient, but they were indicators of religious tolerance of philosophical diversity. I disagreed with literally all of their claims, finding some of them downright offensive. But their existence was necessary to prove a bigger point about the nature of getting at truth and the insights low-reputation groups can bring.

McAfee is something like that for the financial world. His ilk was promiscuous about cryptocurrencies. He didn’t have a tribe. He didn’t take a side. He liked it all, rooted for it all, and took advantage of the opportunities afforded him. From what I can gather (and I am more than willing to be corrected), he never forced anyone to participate in his crypto schemes -- instead he used his wit and personality to convince them to invest, to take a chance.

Given the right circumstances, that’s a crime in the West. We’re not allowed to have agency, as accredited investor laws prove. We’re too delicate. Too fragile.

The McAfees of crypto work, even unknowingly, to toughen our resolve, to push us toward actually, once and for all, doing our damn research. The consequences are too painful otherwise, too costly. The cumulative insulation from such pain, ironically enough, leads to still greater pain. There is no better teacher than experience.

His final troll, an homage, birthed hours after his death. Meet $WHACKD.

From Naomi:

"It’s absolutely important to mention that McAfee’s reported suicide came after news that Spain had agreed to extradite him to the US.

Snowden put it best:

“Europe should not extradite those accused of non-violent crimes to a court system so unfair—and prison system so cruel—that native-born defendants would rather die than become subject to it. Julian Assange could be next. Until the system is reformed, a moratorium should remain.”

John McAfee chose to die rather than suffer the US prison system.

A UK judge denied US extradition of Julian Assange saying that the US prison system would put Assange at risk of suicide.

Ross Ulbricht recently risked time in the hole to get word out to tens of thousands of people at a conference, begging them to fight for prison reform and to get non-violent offenders out of these inhumane places.

The system needs reform. Props to Flote who heard the cries and decided to take up the mantle."

Bitcoin From Scratch

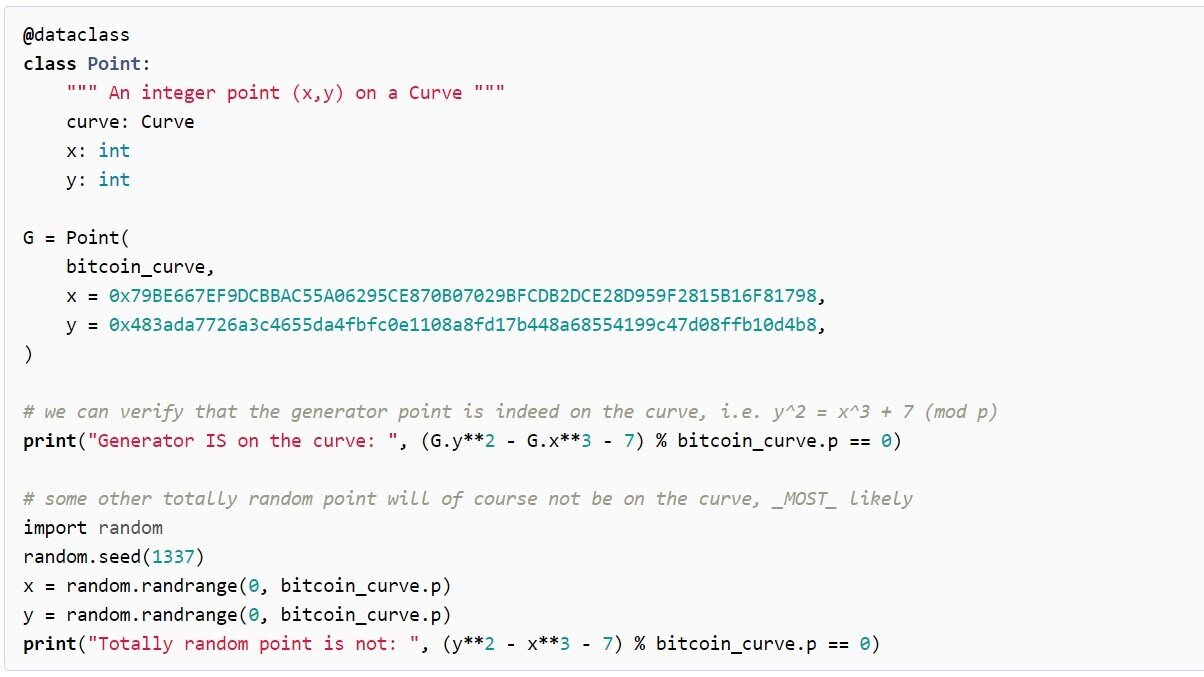

The Senior Director of AI at Tesla, Andrej Karpathy (who leads the neural networks / computer vision team of Autopilot), recently created, digitally signed, and broadcast “a Bitcoin transaction in pure Python, from scratch, and with zero dependencies.” It’s a fascinating tour of Bitcoin’s guts, and takes readers through the coin’s complexity and quirks. Karpathy discovered “Bitcoin is a living, breathing, developing code base that is moving forward with new features to continue to scale, to further fortify its security, all while maintaining full backwards compatibility to avoid hard forks.”

JPMorgan Liink

Claiming more than half of the world’s top banks, 400 leading institutions involved, and 78 countries participating, JPMorgan is giving their blockchain project, Liink a bigger push. It’s a late 2020 rebranding of the bank’s Ethereum-based Interbank Information Network, first launched in 2017 to capture some of the blockchain hype and to compete with the likes of Ripple. It sits atop their proprietary, permissioned blockchain, Onyx. Bloomberg reported recently Onyx trading is topping $1 billion a day and that no less than Goldman Sachs is said to have swapped tokenized versions of US Treasuries for JPM Coins (stablecoin).

Spain’s BBVA Opens Bitcoin Trading Service

That wall-garden institutional arrangement is catching on. Reuters documented Spain’s BBVA offering Bitcoin trading services to its Switzerland clients, which former Wall Streeter Caitlin Long noticed, noting: “traditional (leveraged) bank now trading #bitcoin, which settles in minutes w/ irreversibility.” However, she worried, “Banks’ operations & reconciliation processes are NOT set up for assets w/ such features (most banks settle 1x/day). Add leverage to mix=may not end well.”

Central Banks Step Up Fight Against Cryptocurrencies

“By now, it is clear that cryptocurrencies are speculative assets rather than money,” the Bank of International Settlements (BIS) insisted in its Annual Economic Report, “and in many cases are used to facilitate money laundering, ransomware attacks and other financial crimes. Bitcoin in particular has few redeeming public interest attributes when also considering its wasteful energy footprint.” Their own versions, however, “Central bank digital currencies [...] offer in digital form the unique advantages of central bank money: settlement finality, liquidity and integrity. They are an advanced representation of money for the digital economy [and should be] designed with the public interest in mind.”

Hong Kong Apple Daily Newspaper Uploaded to Blockchain After Government Forces Shut Down

Arweave founder Sam Williams confirmed, “Yesterday, pro-democracy Hong Kong news outlet Apple Daily was forced to close. But not before activists in Hong Kong uploaded much of its contents to Arweave.” A 2019 TechCrunch profile explained:

“Arweave likens itself to an Uber for storage, matching users needing to save files with those with excess storage capacity. But it acts as if there’s no middleman like Uber taking a cut. Instead, the startup will sell tokens as necessary to stay funded until the network is sufficiently decentralized and runs itself.”

Williams continued:

“10,000 pages and other assets from Apple Daily are now stored permanently on the Arweave network. They are being mirrored across ~1,000 nodes, distributed globally. Mining Arweave now means replicating these records of history. They will not be forgotten.”

by C.Edward Kelso, NBTV Head Writer