US Inflation hits 7.5%

US Inflation Reaches 40-year high of 7.5%

The latest US Labor Department CPI numbers are out, and inflation has risen to a 40-year high of 7.5%.

Price increases have been seen across the entire economy:

Wages have risen at the fastest pace in 20 years.

Electricity skyrocketed 4.2% in January alone, up 10.7% over the year.

Furniture and supplies saw the largest one-month increase on record since 1967.

Food costs, air fares, all rose.

Used-car prices: Up 41% from a year ago!

This is what happens when you quadruple the money supply in a year. And yet the money printing continues.

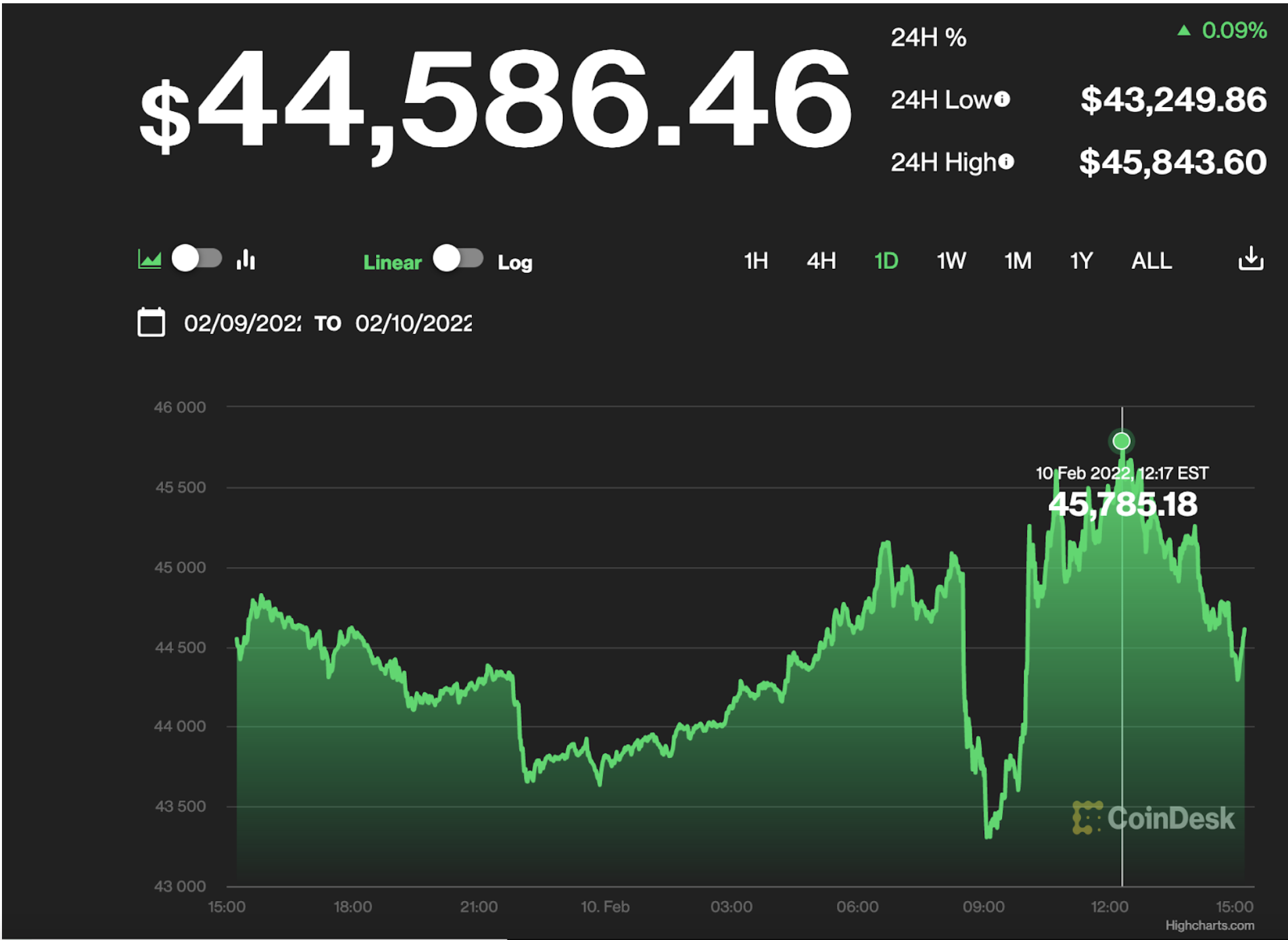

Some have a lack of confidence in the US’ ability to control this monster, and this may be reflected in recent crypto movements. For the last six months Bitcoin has been on a massive bear run, but the price of BTC surged immediately after the CPI numbers were released. Prices recovered by over 5% this week, pushing to nearly $46,000.

Jerome Powell, Fed Chair, said in a January Press Conference that households and businesses are in “good shape financially” (pg 28), and two weeks ago he announcedthat the Fed would begin raising interest rates in March, to try to combat higher-than-expected inflation.

It would be great if they could just turn off that money printer too.

It’s Only Illegal if People Know About It, Right?

Documents were declassified this week that revealed the CIA has been secretly conducting a mass-surveillance program to capture the private information of American citizens. The declassified document was a letter from Senators Ron Wyden (D-Oregon) and Martin Heinrich (D-N.M.), which itself is requesting the declassification of a report by the Privacy and Civil Liberties Oversight Board on a secret CIA bulk collection program.

The letter, sent on April 13, 2021, addressed the Directors of the CIA, and said that the program was:

“entirely outside the statutory framework that Congress and the public believe govern this collection, and without any of the judicial, congressional or even executive branch oversight that comes from [Foreign Intelligence Surveillance Act] collection”.

The CIA’s official statement says that the congressional intelligence committees have been kept fully informed about the program. Wyden and Heinrich claim the opposite is true, that the nature and full extent of the surveillance program has been withheld.

The programs in question were conducted under the umbrella of Executive Order 12333, originally issued by President Ronald Reagan in 1981, and then reissued again in 2008 by President George W. Bush.

Bulk collection means vacuuming up all data indiscriminately, rather than targeting individuals or groups, and it is a serious problem because it amounts to warrantless backdoor searches of Americans. Most foreign intelligence surveillance takes place under EO 12333, not FISA, which means it is subject to no statutory constraints at all, and there is no judicial review or oversight.

Elizabeth Goitein made a great point in her analysis:

“Since when does the Fourth Amendment allow government agencies to help themselves to Americans’ private data as long as they’re conducting agency business? Should police be able to search your house without a warrant as long as they’re investigating a crime?

At this point, you’re probably wondering what kind of data the CIA is collecting in bulk and using to spy on U.S. persons. We don’t know, because the administration is refusing to declassify a single word about the nature of the program.”

Snowden also weighed in:

As Goitein said, Congress cannot continue to allow the executive branch free access to Americans’ most personal data based on outdated factual distinctions that have no relevance to the level of privacy intrusion or risk of abuse.

“No surveillance that has a significant impact on Americans’ privacy should take place without statutory safeguards or judicial oversight. EO 12333 surveillance should have been brought under FISA long ago. The writing is on the wall, and Congress should act now.”

It’s a good time to reach out to your representatives to let them know your thoughts.

It’s NEVER About the Children

The Senate Judiciary Committee unanimously passed a bill paving the way for the Eliminating Abusive and Rampant Neglect of Interactive Technologies Act of 2020 (EARN IT) to move forward.

Make no mistake, the new “EARN IT” bill will effectively ban encryption.

On its surface, the bill says it will will save sexually abused children by setting up a commission that would dictate best practices for the internet. But the reality is, the EARN IT bill isn’t about stopping child porn.

As the Electronic Frontier Foundations said:

“The bill deals with the very serious issue of child exploitation online, but it offers no meaningful solutions. … Rather, the bill’s authors have shrewdly used defending children as the pretense for an attack on our free speech and security online.”

The bill would give the government an open ended power to control content of apps, blogs, messaging platforms, basically a huge chunk of the internet. It does this by modifying the Communications Decency Act’s Section 230.

Section 230 is the most important law protecting free speech online. It basically says that if someone writes something illegal on Facebook, Facebook isn’t considered the author, the person who wrote it is. As soon as Facebook knows about anything illegal on their platform, they still need to take it down, but section 230 provides a necessary distinction between the author and the platform used by an author. Threatening to take this essential legal protection away from platforms if they don’t comply with certain guidelines is a direct attack on internet free speech.

Most importantly: none of these guidelines or “best practices” have actually been written yet! The Bill gives a commission a blank check to write whatever they want, and those behind the bill have made it very clear that banning encryption is at the top of that wish list.

A couple of months before this bill first appeared in 2020, a key sponsor of the bill, Senator Lindsey Graham, said to Apple, Facebook, and other tech companies that if they don’t put backdoors into their devices, “we will do it for you. You’re either the solution or the problem.” Shortly thereafter, the EARN IT bill appeared.

Snowden said at the time: “That such a law is even being considered by Congress, is a national disgrace.”

Every major freedom of speech and privacy advocacy group called it an abomination.

So the government waited for all the noise to die down, and 2 years later it was quietly passed unanimously by the Senate Judiciary Committee.

The bill could now be voted on by the full Senate at any time, or worse, included as part of a different “must-pass” legislative package. We need you to contact your representatives in Congress today to tell them to vote against this bill.

https://www.eff.org/deeplinks/2022/02/key-senators-have-voted-anti-encryption-earn-it-act

Stablecoins Discussed in DC

Stablecoins took the spotlight on Tuesday during a House Financial Services Committee hearing on “digital assets and the future of finance”. The Biden Administration’s Working Group on Financial Markets released a 26 page report on the risk of stablecoins in November, and has been pushing to regulate the stablecoin sector with extremely strict oversight. In an M. Night Shyamalan twist of events, there were actually some members of the House Financial Services Committee who seemed agreeable to stablecoins and to not what to limit involvement.

Rep. Gregory Meeks, D-NY, said:

“It occurs to me that limiting stablecoin issuance to insured depository institutions, which have a high barrier to entry, could limit competition.”

Many committee members across party lines shared in the opinion that whilst a regulatory framework is necessary, the Working Group’s proposal to limit stablecoin issuance to banks is not the best choice for America’s interests.

Crypto supporter Rep. Tom Emmer, R-Minn. criticized the report:

“Banks should not be the only institutions in the ecosystem with dibs to issue the potential array of financial products that the President’s Working Group report simply lumps together as a stablecoin”.

Emmer recently spoke to us in an interview about how the US has to tread carefully if planning to issue their own stablecoin in the form of a CBDC, lest it turn into a tool of surveillance and oppression. He recently introduced his own bill saying that under no circumstances should the Fed be allowed to issue a CBDC directly to consumers.

Also discussed in the hearing this week was whether linking stablecoins to the US dollar posed a risk to the dollar itself. Some lawmakers fear that this could weaken the dollar’s status as the international reserve currency.

Indeed, as people have increasingly more choices in currency, they will gravitate towards the better options.

Bitfinex Arrest: How private are your crypto transactions, really?

Ilya “Dutch” Lichtenstein, 34, and his wife, Heather Rhiannon Morgan, 31, were arrested on Tuesday, accused of laundering 119, 754 bitcoin stolen from Bitfinex in 2016. A US District Court judge has temporarily blocked the bail of the the tech-savvy and undoubtedly colorful couple. The U.S. Department of Justice said that officials have seized 94,000 BTC, worth over $3.5 billion at current market prices. The collaborative investigation was led by special agents from the IRS, FBI, and the Department of Homeland Security.

Court documents released describe a massively complex web of crime. The DOJ was able to piece together a transaction history graph that traces the movement of funds in and out of dark markets and privacy coins, and it’s worth digging into how they were able to do this.

Chain analytics has far less to do with following the movement of UTXOs than people imagine. Analytics companies employ all kinds of other techniques, like:

- Setting up honeypot blockchain explorer sites to link IP addresses to crypto addresses/transaction IDs that people query

- Following the movement of similar amounts of funds and employing machine learning to sort these patterns into clusters and link accounts

- Using geolocating patterns to determine identities.

Some people believe that moving funds into and out of privacy coins will keep them safe from chain analytics. It won’t, because chain analytics uses incredibly advanced machine learning techniques to draw conclusions using ALL the breadcrumbs people leave in their digital lives, not just those on the blockchain. It’s also not helpful to say that a particular coin is private and not the cause of leaked privacy, because how you interact with that coin makes all the different. People might also want to consider which wallets they’re using (eg. is your wallet pinging some API and disclosing all the addresses you wish to find a balance for), whether their ISP can see their activity, where their VPN is located, and a ton of other factors.

Chain analytics were able to uncover the tracks of a couple who allegedly had billions of dollars at their disposal, and hopefully it will lead to criminals who stole a heap of money being brought to justice. Chain analytics also uncovers the tracks of every innocent person too, so if you care about financial privacy you may want to rethink your privacy strategies.

EOS Network Foundation to Sue Block.one for $4.1 Billion

EOS Network Foundation founder, Yves La Rose, just announced intentions to sue original EOS developer, Block.one, for 4.1 Billion dollars for broken promises. He wrote in a blog post on Thursday:

“Block.one has not kept its word regarding past promises and that both the community and individual EOS users have been harmed as a result.”

Originally marketed as “the next big competitor to Ethereum”, the EOS blockchain was launched in June 2018 after a massive ICO. The $4.1 billion raise was to go towards developing the EOSIO protocol (the protocol behind the EOS blockchain), which would be used to develop, host, and run dApps.

Since then, Block.one has moved their attention to their newly created subsidiary, Bullish Global, that is building a cryptocurrency exchange dubbed Bullish. Many in the EOS community see this as a betrayal, and consider Block.one to be abandoning work on the EOS chain itself. Last year, both parties engaged in discussions to “find common ground” but the ENF claims that Block.one left negotiations and subsequently froze vesting for future token earnings.

No officially legal paperwork has been filed as of this writing.

Tune in the the CryptoBeat and PrivacyBeat LIVE shows every Thursday and Friday at 4pmEST!

By Will Sandoval, NBTV Associate Producer, and Naomi Brockwell.