Was 19th Century Free Banking a Failure? Not in the least.

Was 19th Century Free Banking a Failure? Not in the least.

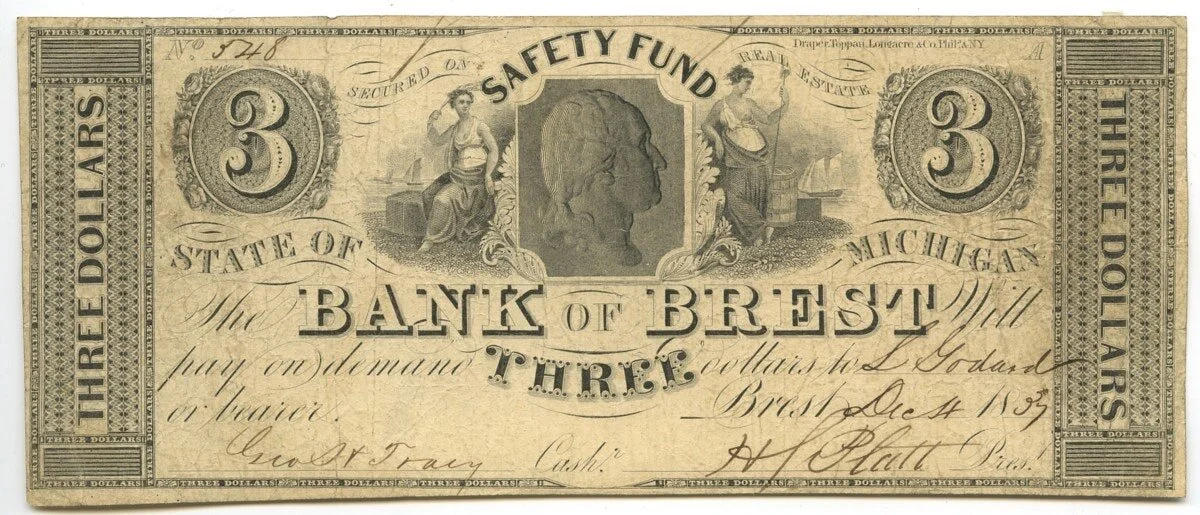

This week Yale Economist, Gary B Gorton, and Federal Reserve attorney, Jeffery Zhang, published an academic paper, musing that although relatively new to the world, Stablecoins are no more than a recycled idea that goes back as far as the wild west:

“...based on lessons learned from history, we argue that privately produced monies are not an effective medium of exchange because they are not always accepted at par and are subject to runs.”

They insist government should preserve “monetary sovereignty,” which they deem as “...critical for establishing monetary policy”.

It parrots popular government rhetoric right now from those who argue that stablecoins must be regulated, lest we revert back to the bygone era of “Wildcat banking”, that was so undesirable for consumers that “it led to the need for a uniform form of money backed by the national government.”

The paper, titled “Taming Wildcat Stablecoins”, wasn’t received well by monetary historians like George Selgin, who said that the way Gorton and Zhang characterize historical examples of free banking is completely off base.

Selgin responded that if these free banking notes were so undesirable, and consumers indeed preferred a uniform, government-issued money, then “there’d have been no need [for] a punitive 10% tax to force state banks to quit issuing their own notes.”

Nic Carter published a similar rebuttal, remarking that these would-be stablecoin regulators and history revisionists “rely on these myths to sell us their proposed solution in the form of CBDCs (Central Bank Digital Currencies). It’s no coincidence the anti-stablecoin contingent is generally fond of CBDCs and believes the state should not only control the issuance of money but also have the power to determine which transactions are valid.”

Pegasus Spyware: Journalists and Activists Targeted

This week more details of the Pegasus leak were released, revealing that journalists and activists were among those targeted by the spyware. For the last few months, a consortium of media outlets and non-profits have joined forces to analyze a leak of 50,000 phone numbers suspected of being targeted by this high-powered spyware sold to authoritarian regimes. The creator of the spyware, Israel-based NSO Group, insists that Pegasus is only intended for use against criminals and terrorists. However the latest leak of targets suggests that the clients of NSO have not been abiding by their usage agreement, and have used the spyware to target not only journalists and activists, but all manner of dissidents and political opponents too. Included on the list was the family of murdered Washington Post reporter, Jamal Khashoggi, and freelance Mexican reporter, Cecilio Pineda Birto, who was apparently of interest to a Mexican client in the weeks leading up to his murder.

Amnesty International released a report this week revealing that Pegasus was and is still being against high-profile political targets “...as recently as July 2021. These also include so-called “zero-click” attacks...which have been observed since May 2018 and continue until now”. Zero-click means that targets did not even need to click anything for malware to be downloaded onto their devices that would make them capable of being surveilled.

It is an interesting question whether governments spend more money buying spyware for targeting political opponents or targeting criminals. As the Pegasus leak unravels, we see very clearly the double-edged sword that is surveillance -- that it is a tool often used to silence those who speak truth to power.

As Snowden said, “A society lacking the virtues of democracy, such as freedom of speech, risks a descent into tyranny.”

Circle Shows Off their Assets

Circle, one of the creators of the #2 most popular Stablecoin, USDC, has revealed this week that 61% of the coin is backed by cash and cash equivalents. The full breakdown of the rest is as follows:

● CDs issued by foreign (non-U.S.) banks – 13%,

● U.S. Treasuries –12%

● Commercial paper accounts – 9%,

● Municipal and corporate bonds – 5%

The specifics of these investment backers have yet to be released, but perhaps more details will come to light later this year, as the company plans to go public via a merger with a “special purpose acquisition company that would value Circle at $4.5 billion”.

It seems like only yesterday we were chastising Tether upon hearing news that it was only 74% backed by cash, and now we’re applauding the transparency of USDC’s 61% revelation.

“Everything is Legal in Jersey”... At Least it Was

Lin-Manuel Miranda joked in Hamilton that, “Everything is legal in Jersey”. He clearly was not referring to the business of crypto-lending. BlockFi, a New Jersey-based crypto-lending platform, currently valued at over 3 billion dollars, received a cease and desist letter on Monday from Acting Attorney General Andrew Bruck. It contends that BlockFi is selling “unregistered securities” to its customers. In a tweet addressing the matter, CEO Zac Prince stated, “We remain firm in our belief that the BlockFi Interest Account is not a security. We are fully operational for all of our existing clients in New Jersey and worldwide, who continue to have access to all products, services, and assets on the BlockFi platform.” The cease and desist order initially went into effect immediately, however the NJ BOS amended the date to July, 29 2021 and the order will not impact existing clients or other products provided by BlockFi.

Is Bitcoin LITERALLY going to the Moon?

Many declared Elon Musk enemy #1, for what they perceived as “turning his back on bitcoin” when Tesla abandoned Bitcoin payments. But this couldn’t be further from the truth. At a conference this week he stated, “SpaceX, Tesla, and I own Bitcoin”, and explained that neither he nor SpaceX have any intention of selling it. “I might pump but I don’t dump,” Musk said.

“I definitely do not believe in getting the price high and selling or anything like that. I would like to see Bitcoin succeed.”

He also announced that Tesla will most likely resume accepting Bitcoin again after reports of improved energy usage were revealed.

During the panel, where he was joined by Jack Dorsey and Cathie Wood, Elon even pressed @Jack about whether Twitter was going to start accepting bitcoin for payments. Dorsey has been a favorite amongst Bitcoiners, while Elon castigated, so to see Dorsey dodge these questions while Elon talks about embracing Bitcoin as a means of payment was an interesting reversal of perceived roles.

Elon also talked of his favorite joke coin, Dogecoin, saying he likes the irreverence of the Doge community, and that they have great memes. I wish more people would take a leaf out of Elon’s book: by embracing levity and humor, and encouraging the use of crypto for payments.

By Will Sandoval NBTV Associate Producer, and Naomi Brockwell